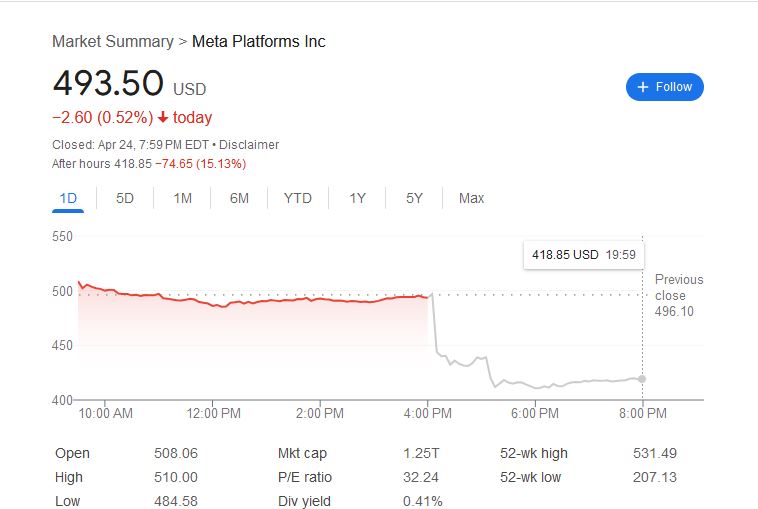

Meta’s shares took a significant tumble, dropping by 10% despite surpassing expectations with their first-quarter earnings. Despite outperforming consensus estimates for both revenue and earnings, Meta Platforms (META) experienced a dip in its stock value following a lower-than-anticipated sales forecast for the current quarter, as announced by company executives.

Moreover, Meta’s ambitious venture into generative artificial intelligence has led to increased costs. The company, headquartered in Menlo Park, Calif., raised its expense forecast, citing necessary infrastructure investments to support its AI roadmap. Consequently, the stock witnessed a steep decline of more than 16% in after-hours trading.

This adverse reaction occurred despite Meta exceeding lofty expectations for its first-quarter performance. The company reported earnings of $4.71 per share on revenue of $36.46 billion for the quarter ending in March. Analysts had anticipated earnings of $4.32 per share on revenue of $36.14 billion. Notably, sales surged by 27% year over year, accompanied by a remarkable 114% increase in earnings.

Looking ahead to the second quarter of 2024, Meta’s guidance fell short of market expectations. The company projected sales in the range of $36.5 billion to $39 billion, with a midpoint of $37.75 billion. This figure lagged behind the $38.25 billion sales projection by analysts. While this guidance still reflects a respectable 18% year-over-year revenue growth, it marks a slowdown compared to previous quarters’ growth rates of 27%, 24.7%, and 23.2%.

However, analysts had anticipated a deceleration in Meta’s growth rate due to challenging year-over-year comparisons. Nevertheless, the revelation of increased expenses, particularly in capital expenditures and overall expenses for the year, may have unsettled some investors.

In light of these developments, Jefferies analyst Brent Thill expressed concerns about the stock’s performance, citing the lighter-than-expected revenue guidance for the second quarter and the upward revisions in expense forecasts.

During an analyst call, Chief Executive Mark Zuckerberg emphasized recent advancements in Meta’s AI technologies, underscoring the company’s commitment to scaling infrastructure to develop leading AI models and services. Zuckerberg indicated a willingness to substantially increase investments in building more advanced models and expanding AI services in the coming years.

Prior to the earnings report, Meta’s stock had shown strong performance, gaining nearly 40% year-to-date and 138% over the past 12 months. Despite the recent setback, Meta stock maintains high ratings, with a Composite Rating of 99 and a Relative Strength Rating of 96 out of 99. It continues to feature on various IBD stock lists, including Tech Leaders, IBD 50, Big Cap 20, and the premium IBD Leaderboard list.